CAP COM Division Member Log In

Or download our mobile App

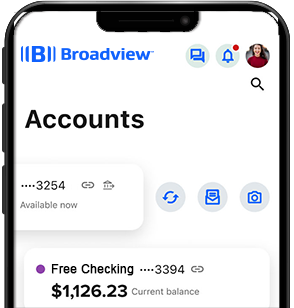

Digital Banking

Your finances at your fingertips

When life gets busy, turn to Broadview’s versatile, 24/7 digital banking services. Access your account online or with the Broadview mobile app.

- Deposit money and pay bills

- Perform transfers

- Add an account

- Apply for a loan or credit card

- Use our free budgeting tool

- Chat with a Broadview FCU representative

![]()

Bank Online

Visit our most popular branch without leaving home. Log in for secure transactions, helpful tools, and more at Broadview.com.

![]()

Bank on the Go

Your phone or mobile device connects you with your finances wherever you may be. See how we make banking easy.

![]()

Save Time with Direct Deposit

Have your income deposited straight into your Broadview checking or savings account.

- Get paid faster

- Pay employees faster

- It’s easy to enroll

- No hidden fees

![]()

Manage Your Account Simply and Securely

Download Broadview’s free1 app for iPhones®, iPads®, and Android devices!

- Check balances

- Make transfers

- Get copies of cancelled checks

- View transaction history

![]()

Pay People

Send funds to friends or family, someone you hire, anybody.

- Send a check with Bill Pay

- Transfer money to a Broadview member

- Reorder checks

- Place stop payments

- Use Apple Pay, Google Pay, or Samsung Pay

![]()

Manage Your Business

Make purchases and pay business expenses online or via the app.

- Pay your bills in a few taps

- Transfer funds between Broadview FCU and other institutions

- Automate recurring payments

- Use your digital wallet at the checkout

![]()

Get Fiscally Fit

Use free account tools to help you build savings, cut expenses, and pay down debt.

- Set up or manage your direct deposit

- Establish goals and budgets

- Keep goals on track with alerts

- Deposit checks with your phone

Make an Easy Move to Broadview

Use ClickSWITCH to streamline your finances with Broadview in just a few clicks:

- Switch accounts elsewhere to Broadview

- Move direct deposits (payroll, Social Security, etc.)

- Establish automatic bill payments

Bill Pay

Pay bills, transfer funds, and more right from your computer or smartphone, all without writing a single check - and all for free with Broadview Bill Pay. You'll save time and stamps, too.

- Pay bills for FREE!

- Receive e-bills online

- Pay all your bills, from the electric company to the landlord

- Have payments directly debited from your Broadview Checking account

- Avoid late payments

- Schedule one-time and recurring payments

Take more control of your finances with Credit Score

Take more control of your finances with Credit Score

Get your credit score for free!

Your credit score doesn’t have to be a mystery. Access your current credit score for FREE via “Credit Score” in online banking or the mobile app.

Take control of your financial wellness

- View your credit score (current and previous)

- View your credit worthiness rating

- Receive recommendations to improve your credit score

- Monitor your credit report and usage

- Access resources to help you improve your finances

- Receive personalized offers

NOTE: Utilizing this feature will not negatively impact your credit score.

Credit Score is free to Broadview FCU members!

Get started today by logging into online banking and selecting “Credit Score” from the “Financial Planning” menu (click “More” to show menus on the mobile app).

Helpful Resources

Helpful Resources

Join Us

Make the most of every Broadview benefit to simplify your finances and bank your way. If you have questions before opening your account, feel free to contact us. And if you’re ready to experience award-winning service from people who put your needs first, we’d love to welcome you.

-

Wireless carrier rates may apply.