CAP COM Division Member Log In

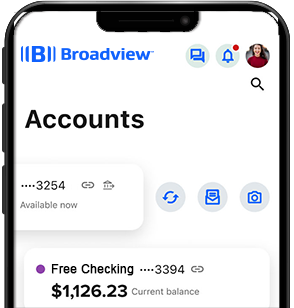

Or download our mobile App

Welcome to Broadview Federal Credit Union Home Page

New Add-On Certificate

Earn up to 4.37% APY^ and keep adding money.

More of what you need for today, and tomorrow.

2023 Tax Information

It's That Time of Year Again

Obtain your tax forms

If you opted for eStatements, obtain your tax forms in the mobile app or online banking.

Financial Literacy Month

Master Your Money

Follow steps to move ahead

Use free resources and tools designed to guide you toward financial success.

2024 Scholarships

Invest in You

This could be your year!

$149,500 in total scholarships will be awarded to 87 students. Hurry and submit your application by April 30!

Young Adult Checking

Free ATMs Worldwide

Access your money, on us

Free ATMs for 14-25 year olds, free Financial Well-Being resources, and bank at 5,600 CO-OP shared branches in the U.S.

National Volunteer Month

People Helping People

Putting compassion into action

We pitch in for our community all year. In 2023, $4.3 million was given back across the areas we serve.

Buy a Car, Pay Less

Wheels Deals is Coming!

Deals April 22-27

We drive hard bargains; you save with exclusive member pricing.

Banking, focused on you.

As partners in your financial success, we’re with you every step of the way, wherever life’s journey takes you.

|

Your College Funding Options Have a Certified College Funding Specialist review your options and help build a plan that suits you – at no cost. |

Bank on the Go Access your account at 5,600 shared branches across the U.S. You can bank at any credit union in the CO-OP network.

|

“I love the ease of having all my accounts with Broadview. From transfers to bill payments, great rates, etc. Broadview makes banking easy!”

Get To Know Us

Get To Know Us

About Broadview

Here, the big picture is all about you. Access services to enhance your financial well-being and head toward new horizons.

Why Choose Us?

As a not-for-profit owned by nearly 500,000 account holders, we can invest more in serving you and our community.

Member Benefits

Lift your life to the next level with resources that strengthen your financial well-being and teams to support your dreams.

Join Us

Experience the Broadview difference.